Introduction to CMC in the Soap and Detergent Industry

Sodium Carboxyl Methyl Cellulose (CMC) has long been recognized as one of the most essential additives in the global detergent supply chain. It functions primarily as a soil suspension agent, preventing redeposition of dirt particles onto fabric during washing. This unique property makes CMC an irreplaceable ingredient in both powder detergents and liquid cleaning products across Asia’s rapidly industrializing economies. As consumers demand improved cleaning efficiency, the role of CMC continues to grow stronger.

In Asia, detergent manufacturers rely on CMC not only for its technical function but also for its cost-effectiveness compared to alternative polymers. The increasing shift toward high-performance washing products, especially in markets like China, India, and Indonesia, places CMC at the center of formulation innovation. Producers are seeking additives that enable performance improvements without significantly increasing manufacturing costs. CMC fits perfectly into this strategy due to its stability, easy incorporation, and proven compatibility with other detergent components.

Between 2025 and 2035, the demand for CMC is projected to expand steadily as the region’s soap and detergent sectors grow. Household consumption trends, rising hygiene standards post-pandemic, and the expansion of detergent manufacturing hubs across Asia all contribute to market acceleration. This introduction sets the foundation for understanding why CMC will remain a strategic material for the next decade.

Market Drivers: Why CMC Demand Is Rising (2025 - 2035)

One of the major drivers of CMC demand is the increased penetration of washing machines in Asia-Pacific households. Countries such as India, Vietnam, and the Philippines are witnessing rising disposable incomes, resulting in greater consumption of laundry detergents designed for automatic machines. These formulations require higher-grade additives, especially polymers like CMC that ensure fabric care and efficient suspension of soil in lower-water washing cycles. As washing machines become more accessible, detergent manufacturers increase reliance on high-quality CMC to meet consumer expectations.

Another key driver is the shift toward eco-friendly detergent products. Many global and regional brands are committing to reduced chemical footprints and biodegradable raw materials. CMC, being cellulose-based, aligns perfectly with these sustainability goals. This trend is particularly strong in Japan, South Korea, and Singapore, where consumer awareness of eco-friendly formulations is high. Manufacturers increasingly view CMC as a suitable replacement for certain synthetic additives that may raise environmental concerns.

Additionally, industrial-scale soap and detergent production in Asia continues to grow, supported by multinational investments. Large companies establish manufacturing bases in Thailand, Malaysia, and Indonesia due to competitive labor and raw material availability. These expansions generate consistent demand for detergent-grade CMC. Between 2025 and 2035, production capacity expansions throughout the region will directly influence the long-term consumption curve of CMC in the sector.

Innovation Trends in CMC Production and Applications

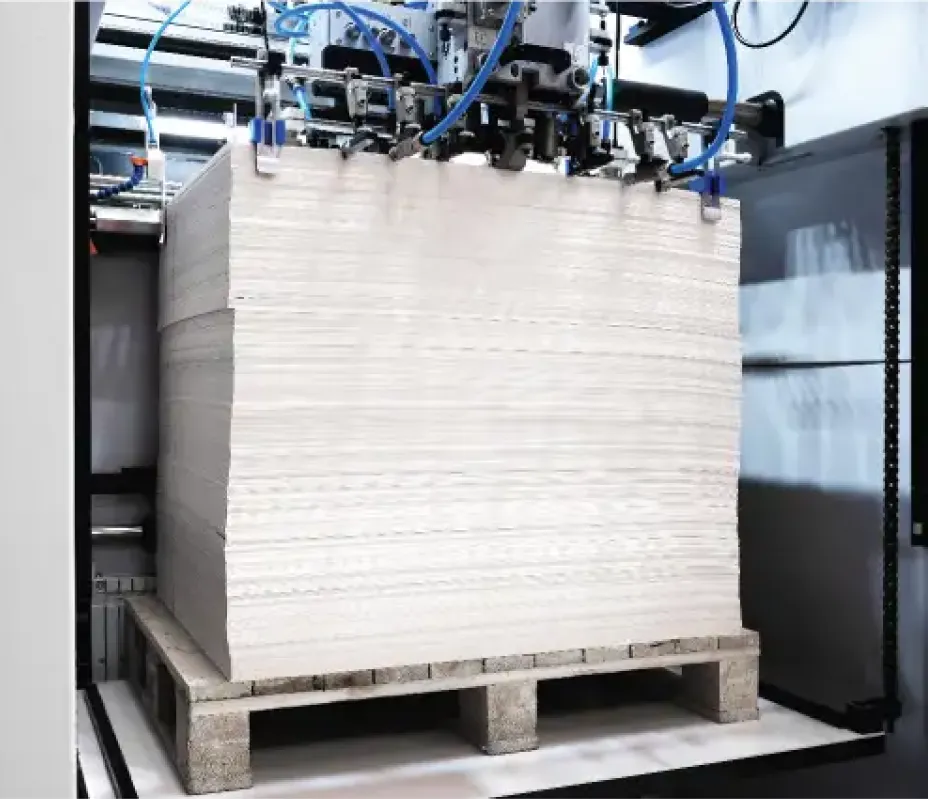

CMC innovation is accelerating as manufacturers aim to enhance performance properties and reduce production costs. One emerging trend is the adoption of advanced etherification technologies to produce CMC with more uniform substitution levels. This leads to better viscosity control, improved solubility, and enhanced suspension capability in detergent formulations. Asia-based producers, especially in China, are investing heavily in modernizing production facilities to achieve consistent quality that meets international detergent manufacturers’ standards.

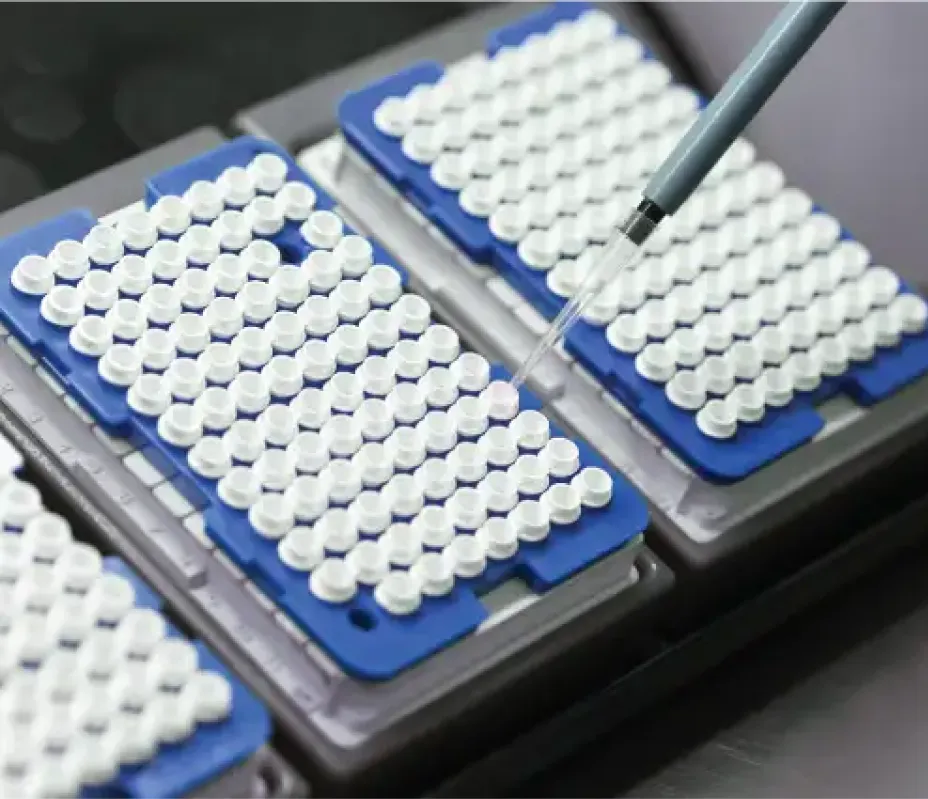

Another innovation trend involves the development of ultra-pure CMC grades tailored for premium liquid detergents. Unlike traditional powder detergents, liquid formulations require highly refined CMC that dissolves instantly without forming lumps. Researchers and chemical companies across South Korea and Japan are collaborating to produce new CMC variants engineered specifically for transparent, high-clarity liquid cleaners. This is expected to open new market segments between 2027 and 2035.

There is also growing interest in hybrid polymer systems that combine CMC with other natural or synthetic thickening agents. These hybrid systems are being explored to improve water retention, viscosity stability, and fabric care properties. Such innovations respond directly to consumer preferences for detergents that deliver both cleanliness and fabric softness. With Asia’s detergent market becoming more competitive, innovation in CMC-based formulations represents a critical differentiator for manufacturers.

Regional Market Analysis: Asia’s Role in CMC Growth

Asia remains the largest global consumer of detergent-grade CMC, driven by massive populations, expanding middle classes, and robust manufacturing industries. China, in particular, is both the leading producer and consumer of CMC. The country hosts dozens of manufacturing facilities that supply high-quality detergent-grade CMC to domestic and international customers. The domestic detergent market, fueled by strong purchasing power and brand competition, ensures sustained CMC demand. From 2025 to 2035, China’s share of global CMC consumption is expected to remain above 35%.

India represents another major growth engine for the CMC market. Rapid urbanization and lifestyle changes have accelerated the shift from traditional washing methods to modern detergents. The introduction of affordable washing machines and extensive marketing by detergent brands are shaping local demand. As Indian consumers increasingly prefer performance-oriented cleaning products, CMC demand rises proportionally. Many Indian detergent producers now require higher-grade CMC to remain competitive against global brands.

Southeast Asia including Indonesia, Malaysia, Thailand, and Vietnam also plays a significant role. The region’s detergent market is expanding due to young populations, industrial growth, and rising household incomes. Indonesia, for example, has become a hotspot for detergent manufacturing investments as companies seek to serve both domestic and ASEAN markets. This shift benefits CMC suppliers significantly, as local producers require consistent, reliable raw materials for their soap and detergent lines.

Challenges Facing the CMC Market (2025 - 2035)

Despite strong growth prospects, the CMC market faces several challenges that may influence pricing and supply stability over the next decade. One major challenge is price volatility tied to fluctuations in the cost of cellulose-based raw materials. Changes in pulp availability, transportation constraints, and energy costs directly affect CMC production. Asian manufacturers, including those in China and India, must adapt to these fluctuations by optimizing procurement and production processes.

Another challenge comes from increasing competition with alternative polymers such as polyacrylates and other synthetic thickeners. While CMC is preferred for its biodegradability, some synthetic additives offer superior performance under specific conditions, such as high-temperature washing or extremely hard water environments. Detergent manufacturers may shift formulations based on cost or performance factors, forcing CMC producers to innovate continuously.

Regulatory pressures also present challenges. As governments strengthen environmental and safety regulations, CMC producers must ensure compliance with stricter standards. Countries like Japan and South Korea enforce rigorous chemical safety rules, requiring manufacturers to meet higher quality benchmarks. Although these regulations improve product reliability, they may raise production costs. Navigating this regulatory landscape will be essential for sustaining CMC growth through 2035.

Forecast and Future Outlook (2025 - 2035)

The CMC market outlook from 2025 to 2035 remains strong, with estimated compound annual growth rates (CAGR) between 4.5% and 6% in the detergent sector alone. This growth will be heavily influenced by Asia’s expanding consumer base and rising preference for premium laundry products. Demand for CMC is expected to increase significantly in markets where urbanization is rapid, particularly in India, Vietnam, and Indonesia.

Technological advancements will further solidify CMC’s position in detergent formulations. By 2030, more producers are expected to launch next-generation detergent additives featuring enhanced compatibility with cold-water washing systems. These innovations will allow CMC to capture new market share, especially among environmentally conscious consumers who prefer energy-efficient laundry practices.

Finally, supply chain diversification is likely to reshape the competitive landscape. More CMC production facilities are expected to emerge outside China as companies seek to reduce dependency on a single country. This will create new opportunities in regions such as India and Southeast Asia, where demand and production capacities are rising simultaneously. Overall, the future outlook for CMC in the soap and detergent industry is promising, driven by innovation, sustainability, and strong regional demand.

Conclusion

Sodium Carboxyl Methyl Cellulose (CMC) will continue to play a vital role in the evolution of the soap and detergent industry across Asia. Its multifunctional properties, cost advantages, and compatibility with modern formulations make it an indispensable component for detergent manufacturers. As innovation accelerates and sustainability becomes a priority, CMC is positioned to remain a preferred additive well into 2035.

The next decade will bring challenges, including competition, regulatory expectations, and raw material fluctuations. However, with strategic investments in technology and regional expansion, CMC producers can capitalize on Asia’s dynamic market. For detergent companies seeking enhanced performance, improved formulation stability, and eco-friendly options, CMC remains a strategic ingredient for long-term growth. For sourcing guidance, technical support, or customized CMC solutions to strengthen your detergent formulations, you can reach our team through the Contact Us page at Detergent Chemicals Asia.

English

English

Indonesian

Indonesian

简体字

简体字

العربية

العربية

Español

Español

Français

Français

Português

Português

日本語

日本語

한국어

한국어

Tiếng Việt

Tiếng Việt

Leave a Comment